By Vaishali Basu Sharma

Risks of Over-Reliance on China: What Bangladesh Can Learn from Sri Lanka and the Maldives

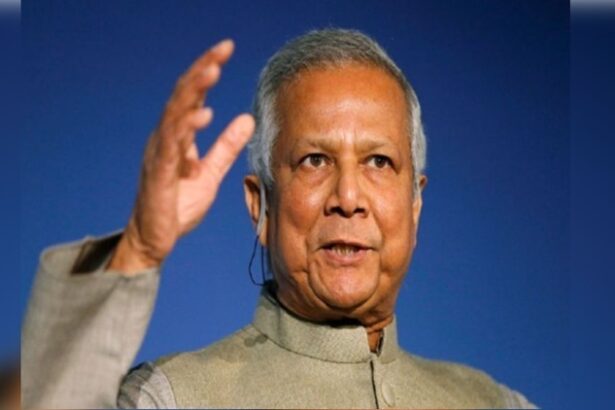

Traveling on a flight arranged by the Chinese government, Bangladesh interim government Chief Adviser Professor Muhammad Yunus is heading a 57-member delegation, which includes Foreign Adviser Touhid Hossain, along with officials and security personnel to China for a four day visit. He is scheduled to meet President Xi Jinping at the Great Hall of the People in Beijing on March 28.

It is clear that Muhammad Yunus, has not prioritized relations with India since taking office in August 2024. Reports suggest that he has yet to visit India, which some interpret as a sign of strained ties. This shift comes after the removal of Sheikh Hasina, a long-time ally of India, from power. Yunus’s growing engagement with China, including his current visit, has further highlighted this diplomatic cooling

It does seem that Yunus is adopting a strategy to leverage relations with China, potentially as a counterbalance to India, given the strained ties with the latter. Bangladesh’s proximity to India has historically ensured strong ties, yet China’s vast investments and diplomatic courting can present appealing alternatives for leadership looking to recalibrate relations. If Yunus continues this approach, it could shift Bangladesh’s geopolitical alignment, potentially making it heavily dependent on China, and possibly leading to a more complex situation.

This tactic—playing one regional power against the other—isn’t uncommon for smaller nations seeking to amplify their influence or secure greater economic and strategic benefits. China’s economic power and investments can provide significant benefits, such as infrastructure development, trade opportunities, and financial aid. On the other hand, this dependency can create vulnerabilities, especially if China’s policies or economic conditions shift.For instance, nations relying on Chinese loans for infrastructure projects may face debt challenges, as seen in cases like Sri Lanka, Pakistan, Maldives in South Asia. Additionally, over-reliance on Chinese trade can expose countries to economic risks if demand fluctuates or geopolitical tensions arise. Balancing these benefits and risks is a delicate act for many nations.

During his visit to China, Chief Adviser Professor Muhammad Yunus is set to hold a high-level meeting with Chinese President Xi Jinping. Bangladesh plans to prioritize economic cooperation, while China is expected to focus on broader political collaboration, emphasizing the One China principle and encouraging Bangladesh to join Xi Jinping’s Global Development Initiative (GDI).

According to discussions with several diplomatic sources, it has been revealed that Bangladesh prioritizes financial and developmental assistance, while China is less inclined to focus on economic cooperation. Instead, China views economic cooperation as one component of the relationship, emphasizing that collaboration should also be approached from a political perspective to elevate Dhaka-Beijing ties to the next level, considering this approach to be pragmatic.

Beijing is urging Dhaka to reaffirm its strong support for the One-China principle and its stance on the Taiwan issue, consistent with the position Bangladesh maintained in the 2005 joint communique. This aligns with China’s broader diplomatic strategy to ensure unwavering support from its partners on sensitive issues like Taiwan.

Bangladesh’s deepening engagement with China could have several repercussions. But more importantly its increased reliance on Chinese investments and loans might expose Bangladesh to debt risks, as seen in other countries involved in China’s Belt and Road Initiative. Sri Lanka’s experience serves as a cautionary tale about the risks of over-reliance on Chinese investments and loans. The country faced significant debt challenges, particularly with projects under China’s Belt and Road Initiative (BRI). For example, Sri Lanka had to lease the Hambantota Port to a Chinese company after struggling to repay the loans associated with its development. This situation highlights how dependency on high-interest loans for large-scale infrastructure projects can lead to financial strain and loss of strategic assets.

Maldives and Pakistan provide further examples of how increased reliance on Chinese investments and loans can lead to significant debt risks. The Maldives has faced mounting debt challenges, with external debt reaching $3.4 billion, a significant portion owed to China. The China-Maldives Free Trade Agreement has exacerbated economic vulnerabilities, with Maldivian exports making up less than 3% of bilateral trade. The country is now struggling to service upcoming debt repayments, including $600 million in 2025 and $1 billion in 2026.

The Maldives’ Free Trade Agreement (FTA) with China has sparked concerns about its potential impact on the Maldives’ economic sovereignty and independence. Maldivian Democratic Party (MDP), Chairman Fayyaz Ismail, a former economic development minister, criticized the agreement following its revival under President Muizzu. He argued that as a country heavily reliant on imports—95% of its goods are imported—the Maldives must prioritize trade policies that safeguard its economic sovereignty. Eliminating tariffs for Chinese goods, Fayyaz cautioned, would flood the market with cheaper Chinese products, undermining local businesses and limiting the Maldives’ ability to diversify trade partnerships.

The agreement exemplifies how smaller nations can face significant challenges when balancing economic partnerships with larger powers like China. It underscores the importance of maintaining independence and ensuring that trade agreements benefit the domestic economy.

Pakistan’s case highlights the potential pitfalls of over-reliance on Chinese financing, particularly when terms are opaque or heavily skewed in favor of the lender. The China-Pakistan Economic Corridor (CPEC), initially hailed as a transformative project, has placed Pakistan under immense financial strain. With loans tied to high-interest rates and stringent repayment terms, Pakistan owes approximately $28.78 billion to China, accounting for 22% of its external public debt. Projects like Gwadar Port have faced criticism for benefiting China more than Pakistan, further deepening the economic burden.

Maldives President Mohamed Muizzu’s recent shift toward a softer stance on India marks a departure from his earlier position when he took office, advocating for the withdrawal of Indian troops and promoting China-backed projects. His campaign placed the Maldives at the center of the India-China rivalry, with both powers vying for influence over the strategically located Indian Ocean nation. Breaking with the tradition of Maldivian presidents visiting India first after elections, Muizzu chose Turkey and China instead.Muizzu had sought to reduce reliance on India by pursuing a more independent foreign policy and fostering closer ties with China.

However, India’s recent bailout has highlighted the limitations of this approach. Muizzu, who was seen as a leading figure in the “India Out” movement, worked to restore relations with India before the end of 2024, in an attempt to reinstate the soured ties.

Sri Lanka’s debt crisis is a cautionary tale of economic mismanagement and over-reliance on external loans, particularly from China. Sri Lanka borrowed heavily from China to fund large-scale infrastructure projects, such as the Hambantota Port and Mattala Rajapaksa International Airport. While these projects were intended to boost economic growth, many were criticized as being economically unviable, leading to limited returns on investment.

By 2022, Sri Lanka’s external debt had ballooned to unsustainable levels, with China being one of its largest creditors. The country struggled to meet its debt obligations, and in April 2022, it defaulted on its sovereign debt for the first time in history. Sri Lankans faced shortages of essential goods, skyrocketing inflation, and prolonged power outages. These conditions sparked widespread protests, culminating in the resignation of President Gotabaya Rajapaksa.

Amid the crisis, India stepped in to provide critical support. It extended financial assistance worth over $4 billion, including credit lines and grants, to help stabilize Sri Lanka’s economy. This aid was instrumental in addressing immediate needs and securing an International Monetary Fund (IMF) bailout.

Sri Lanka’s experience underscores the risks of over-reliance on external loans without careful consideration of their economic viability.

Muhammad Yunus should learn from Sri Lanka and the Maldives about the risks of over-reliance on China. To avoid similar pitfalls, Yunus should ensure transparency, economic viability, and balanced partnerships in Bangladesh’s dealings with China.

Author

Vaishali Basu Sharma

*The author is an analyst on geopolitical and macroeconomic issues*

The views expressed here are the author’s own and do not necessarily reflect the organization’s

The post Risks of Over-Reliance on China: What Bangladesh Can Learn from Sri Lanka and the Maldives appeared first on Newswire.